nh food sales tax

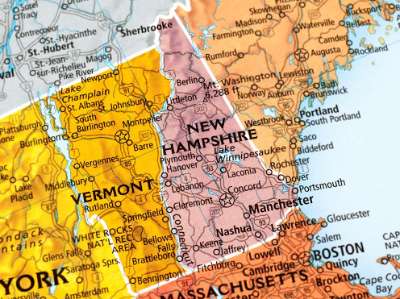

Exact tax amount may vary for different items. New Hampshire is one of the few states with no statewide sales tax.

The state sales tax rate in New Hampshire is 0000.

. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For additional assistance please call the Department of Revenue Administration at 603. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more.

Wayfair decision earlier this summer has stripped New Hampshire retailers. 2022 New Hampshire state sales tax. That means that nearly any product can be purchased tax-free although there are exceptions.

Additionally there are no local sales taxes in New Hampshire cities or counties. New Hampshire is one of the few states with no statewide sales tax. A 9 tax is also assessed on motor.

New Hampshire Sales Tax Rate New Hampshire is one of the five states in the USA that have no state sales tax. Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85. A 9 tax is also assessed on motor vehicle rentals.

A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. While New Hampshire lacks a sales tax and personal income tax it does have some of the highest property taxes in the country. The sales tax rate in New York state is 4 and New York City has additional tax rates which when combined with the state tax rate makes the rate closer to 9.

New Hampshire is one of the few states with no statewide sales. The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0. Additional details on opening forms can be found here.

To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. New Hampshire is a sales tax free state. The tax is collected by hotels restaurants caterers and other businesses.

There are no sales taxes on. Tax Rate Starting Price. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is.

They send the money to. The state sales tax rate in New Hampshire is 0 but you can customize this table as needed to reflect your applicable local sales tax rate. There are however several specific taxes levied on particular services or products.

The state does tax income from interest and. If you have a substantive question. These excises include a 9 tax on.

File and pay your Meals Rentals Tax online. There are no local taxes beyond the state rate. Nh Food Tax Calculator.

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on.

Cost Of Living In New Hampshire How Does It Stack Up Against The Average Salary

New Hampshire Sales Tax Handbook 2022

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

5 States Without Sales Tax Thestreet

State Sales Tax Free Weekend Shopping Just Updated 2022

Murphy S Law City County Sales Tax Proposal Dead Urban Milwaukee

New Hampshire Income Tax Calculator Smartasset

New Sales Tax Rules For Online Sellers Godaddy Blog

States Without Sales Tax Article

You Asked We Answered Why Is New Hampshire So Against Having An Income Tax New Hampshire Public Radio

4 Ways To Calculate Sales Tax Wikihow

How Are Groceries Candy And Soda Taxed In Your State

Event Sales Tax Basics What Is Taxable Exemptions Which States Are Marketplace States And More Events Com

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)